Working an internet enterprise means each deserted cart hurts. My pal realized this the laborious means when his anime subscription service began getting curiosity from UK clients who stored leaving with out shopping for. 😟

The wrongdoer? He wasn’t providing Bacs Direct Debit, which is a cost technique that many UK clients want for recurring funds.

We spent a weekend researching options, and I used to be amazed at how rapidly we received Bacs Direct Debit engaged on his WordPress website utilizing WP Easy Pay.

No developer calls, no sophisticated setup—only a plugin that made accepting this cost technique as simple as accepting bank cards.

That have made me notice what number of WordPress website house owners could also be dropping gross sales just because they don’t understand how simple it’s to supply extra cost choices.

I’ve since examined the highest options, and I’m right here to indicate you precisely arrange Bacs Direct Debit in your web site with none technical complications.

💡Fast Reply: Methods to Settle for Bacs Direct Debit Funds

In a rush? Should you simply need the options with out all the small print, right here’s what I’ll be overlaying:

Technique 1: WP Easy Pay – Finest for providers, subscriptions, or single merchandise. No on-line retailer wanted.

Technique 2: WooCommerce (Guide Bacs Funds) – Makes use of built-in “Bacs/Direct Financial institution Switch.” Easy setup, however handbook verification is required.

Technique 3: WooCommerce (Automated Direct Debit Plugin) – Absolutely automated answer for WooCommerce shops with recurring funds.

These three strategies cowl most use instances. I like to recommend selecting the one which matches your product kind and retailer setup.

What’s Bacs Direct Debit?

Bacs Direct Debit is a straightforward means for companies to gather funds straight from a UK buyer’s checking account. It’s excellent for subscriptions, memberships, or recurring invoices.

Bacs stands for ‘Bankers’ Automated Clearing Providers’ and is extensively used within the UK to maneuver cash safely between accounts.

In contrast to bank cards or PayPal, funds go straight from the financial institution. This implies clients don’t have to enter their particulars every time.

It’s additionally tremendous common. Many UK adults use it to pay common payments, and billions of kilos transfer this fashion every month.

Why Settle for Bacs Direct Debit Funds?

It’s easy, dependable, and one thing UK clients already belief. Listed here are the principle advantages of utilizing Bacs:

💰 Decrease transaction charges – Normally extra reasonably priced than bank cards or PayPal.

🛡️ Greater buyer belief – Backed by the UK Direct Debit Assure.

🌍 Extensively adopted within the UK – Hundreds of thousands of companies and clients already use it.

🔄 Straightforward recurring billing – Excellent for subscriptions or common funds.

⚡ Fewer cost failures – Financial institution-to-bank funds are usually extra dependable.

📈 Higher money movement administration – Scheduled funds arrive mechanically, making enterprise planning simpler.

👍 Handy for purchasers – No want to recollect card particulars or log in to a number of accounts.

General, providing Bacs Direct Debit makes paying simpler for UK clients. It reduces friction at checkout and improves your possibilities of getting paid on time.

UK Guidelines for Accumulating Bacs Direct Debit Funds

Earlier than you begin, listed here are the principle guidelines to know when gathering Direct Debit funds:

🔑 Service Consumer Quantity (SUN): You will want a SUN to gather funds. This license quantity exhibits Bacs that what you are promoting is permitted to take funds from buyer accounts. Massive firms can usually get one from their financial institution. Smaller companies normally can’t, in order that they work by means of a bureau as a substitute.

🏢 Bacs-approved bureau: This can be a trusted third get together permitted by Bacs. Should you don’t qualify on your personal SUN, a bureau helps you to use theirs. They deal with the technical and compliance elements for you.

🔒 GDPR (information safety): You could deal with financial institution particulars securely, solely retailer what’s obligatory, and at all times get the shopper’s consent. GDPR is a UK/EU privateness regulation that protects clients’ private information, together with cost data.

✅ Sturdy Buyer Authentication (SCA): SCA is a safety rule within the UK and EU that typically requires an additional id verify earlier than a cost goes by means of. For instance, a buyer might affirm a cost by means of their banking app or with a code despatched to their telephone. This one-time authorization is often all that’s wanted to arrange a safe recurring cost plan.

📖 Official steering: For the most recent updates, it’s at all times greatest to verify the official Bacs web site.

👉 These steps might seem to be lots, however most small companies use Stripe like my pal did. That means, you keep compliant whereas retaining the cost course of easy for each you and your clients.

Technique 1: Settle for Bacs Direct Debit Funds With WP Easy Pay (For Single Merchandise, Subscriptions, or SaaS Providers)

Should you’re promoting subscriptions, SaaS merchandise, and even only a single digital or bodily product, then WP Easy Pay is the plugin I like to recommend.

It’s the greatest WordPress Stripe plugin, designed for companies to simply accept funds with out organising a full eCommerce retailer.

WP Easy Pay connects straight with Stripe. It even features a pre-made Bacs Direct Debit template, letting you begin accepting funds in only a few clicks.

There’s no sophisticated setup and no coding required — you merely set up the plugin, allow Bacs, and also you’re able to go.

Should you’d like a deeper dive into all of its options, you’ll be able to try our full WP Easy Pay assessment.

Step 1: Set up and Activate WP Easy Pay

First, you want to join an account on the WP Easy Pay web site. Simply click on on the ‘Get WP Easy Pay Now’ button and observe the signup directions.

🚨Word: WP Easy Pay has a free model, however you’ll want the Professional plan to unlock the Bacs Direct Debit cost template.

Subsequent, that you must set up and activate the WP Easy Pay plugin. For detailed directions, see our tutorial on set up a WordPress plugin.

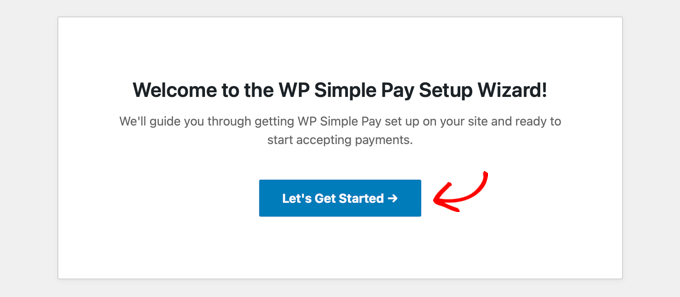

Upon activation, the setup wizard will mechanically launch in your display screen. Right here, it’s a must to click on the ‘Let’s Get Began’ button.

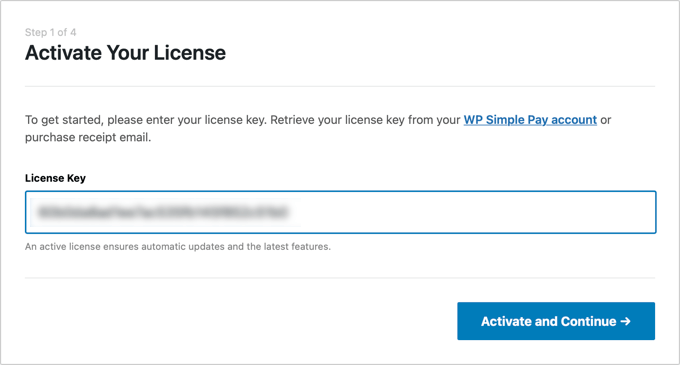

It will take you to the following step, the place that you must enter your license key.

You’ll find this data in your account on the WP Easy Pay web site. Getting into it would unlock the professional options required to simply accept Bacs Direct Debit funds.

Step 2: Connect with Stripe

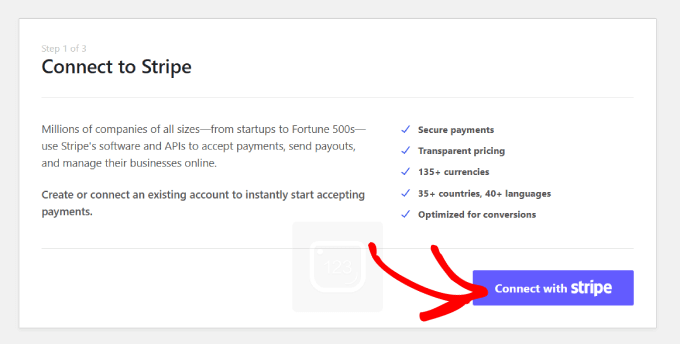

After that, you’ll be requested to attach your website with Stripe.

Since WP Easy Pay is a Stripe-powered plugin, it gained’t work till you join it with a Stripe account. Should you don’t have already got one, you’ll be able to create a brand new Stripe account throughout this course of.

Stripe is what makes the Direct Debit work within the background. In contrast to card funds, Bacs takes a couple of working days for the cash to maneuver out of your buyer’s financial institution.

As soon as Stripe is related, WP Easy Pay takes care of the whole lot. For extra particulars, verify our step-by-step information on accepting Stripe funds in WordPress.

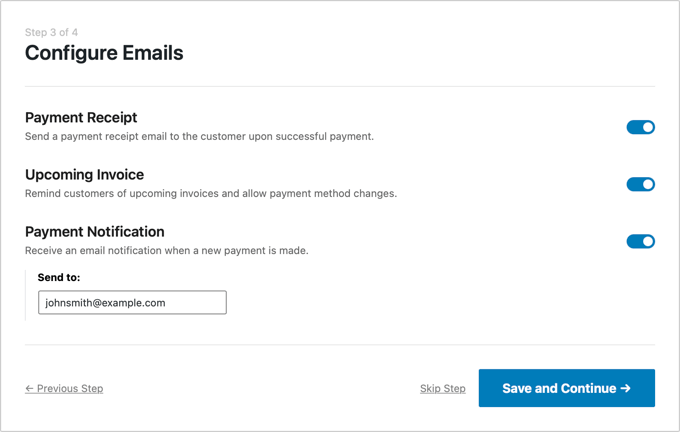

Step 3: Configure WP Easy Pay Settings

Subsequent, the wizard will information you to arrange your e-mail notifications. Right here you’ll be able to allow choices to obtain e-mail notifications for cost receipts, upcoming invoices, and cost notifications.

It’s also possible to select the e-mail handle the place you wish to obtain these notifications.

While you’re completed, click on ‘Save and Proceed’ to maneuver to the ultimate setup steps.

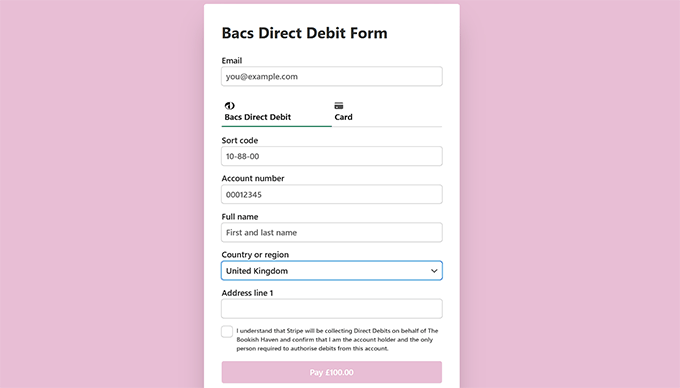

Step 4: Create a Bacs Direct Debit Fee Kind

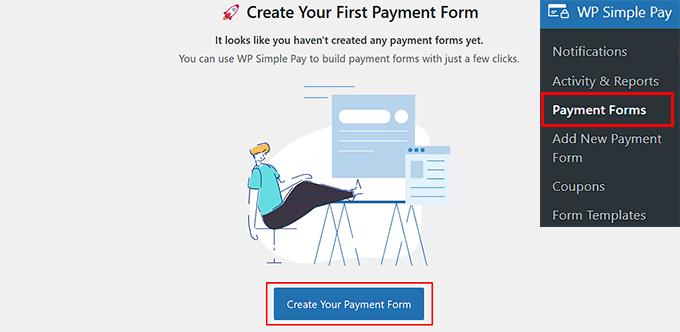

At this level, WP Easy Pay will end configuring your website, and also you’ll be able to create your Bacs Direct Debit cost kind.

For this, head over to the WP Easy Pay » Fee Kinds web page out of your WordPress dashboard and click on the ‘Create Your Fee Kind’ button.

It will take you to the template library.

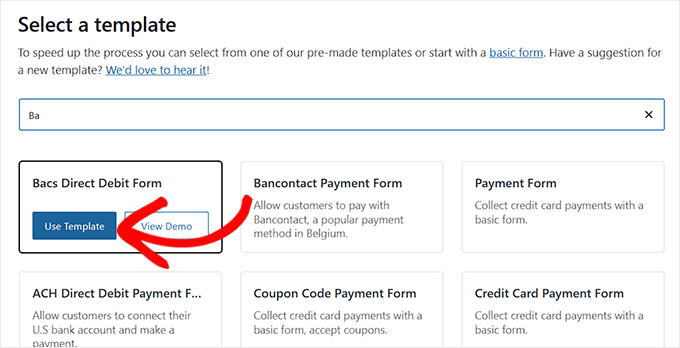

WP Easy Pay offers you loads of premade templates, however since we’re specializing in Direct Debit, go forward and choose the ‘Bacs Direct Debit Kind’ template.

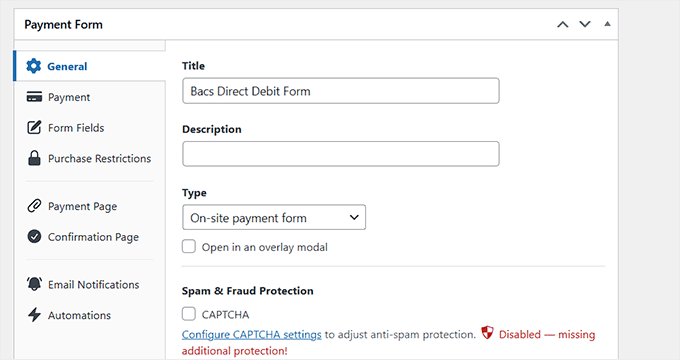

When you’ve finished that, you’ll land on the ‘Add New Fee Kind’ web page.

Right here you’ll be able to add a title and outline on your kind. I counsel retaining these quick and clear since your clients will see them throughout checkout.

With the fundamentals in place, ensure that the shape kind is about to ‘On-site cost kind.’ This ensures your clients can end checkout with out leaving your website.

If you wish to add a bit extra safety, I additionally advocate checking the ‘Spam & Fraud Safety’ field. It provides a CAPTCHA to your kind, defending it from malicious bots.

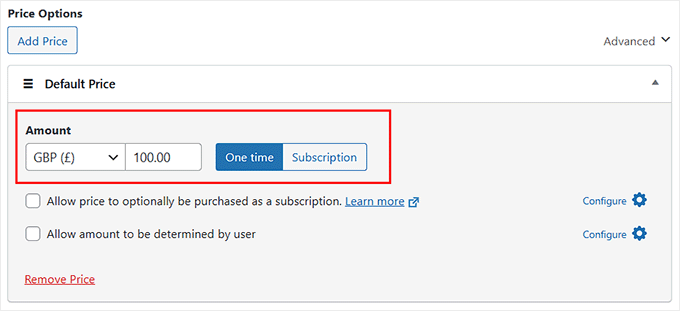

Subsequent, transfer over to the ‘Fee’ tab on the left. That is the place you’ll set the value on your services or products.

Should you’re providing a subscription, select ‘Subscription’ and click on ‘Add Value’. You possibly can create a number of tiers, like a Primary Plan at £10/month and a Premium Plan at £20/month.

Nevertheless, if you’re simply promoting a single product and don’t have to arrange recurring funds, you’ll be able to select the ‘One time’ choice and add your pricing.

At this stage, don’t overlook to set your forex to ‘GBP’.

Bacs Direct Debit solely works with British kilos. Should you set a special forex, like USD or EUR, then funds gained’t course of accurately.

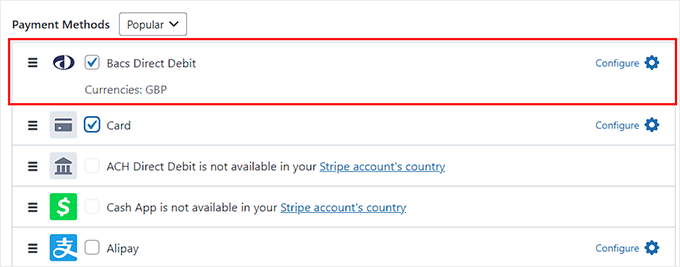

As you scroll down, you’ll see the ‘Fee Strategies’ part. Right here, that you must ensure that ‘Bacs Direct Debit’ is chosen.

You’ll additionally discover that WP Easy Pay helps different choices like SEPA, Money App, Bancontact, and extra.

I like to recommend including each Bacs and bank card funds in order that your UK and worldwide clients have the flexibleness to pay the way in which they like.

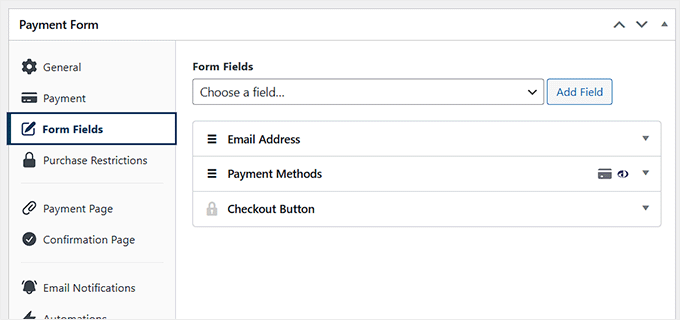

As soon as that’s set, swap to the ‘Kind Fields’ tab. That is the place you’ll be able to determine what data you wish to accumulate.

You possibly can drag and drop fields, add new ones, or take away ones you don’t want.

For instance, if you happen to’re promoting a digital service, you would possibly simply hold title and e-mail. However if you happen to’re delivery a bodily product, you’ll positively wish to embrace an Deal with discipline.

Step 5: Publish Your Bacs Direct Debit Fee Kind

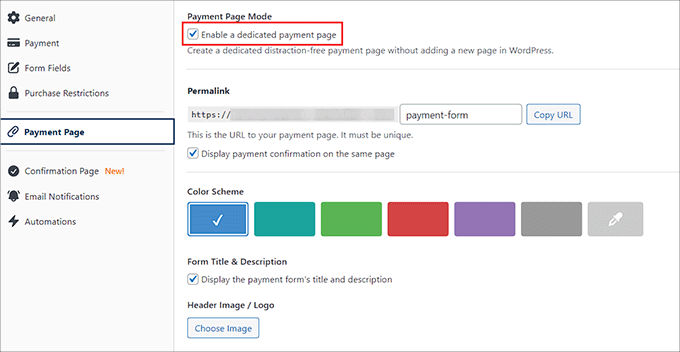

Lastly, head to the ‘Fee Web page’ tab and verify the ‘Allow a devoted cost web page’ field.

WP Easy Pay will now create a standalone web page on your kind with none work from you.

It’s also possible to set a permalink, choose a shade scheme on your cost kind, add what you are promoting brand, and show footer textual content from right here.

When you’re pleased with the setup, click on ‘Publish’ to save lots of your kind.

Now you can go to your WordPress web site to see the Bacs Direct Debit cost kind in motion.

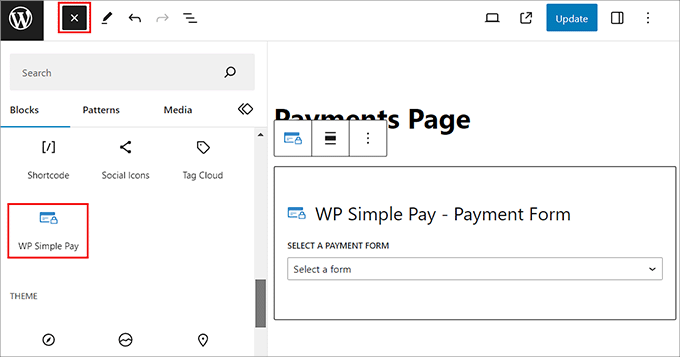

Should you’d fairly not use a devoted web page, you’ll be able to simply add the shape to any current web page.

To do that, simply click on the ‘Publish’ button after including kind fields.

Then, open the web page or submit the place you wish to add the Bacs kind and click on the ‘Add Block’ (+) button within the prime left nook.

It will open the block menu, the place it’s a must to search and add the WP Easy Pay block. Then, choose the cost kind you created from the dropdown menu inside the block.

While you’re finished, simply click on the ‘Replace’ or ‘Publish’ button to retailer your settings.

Your Bacs Direct Debit kind is now stay.

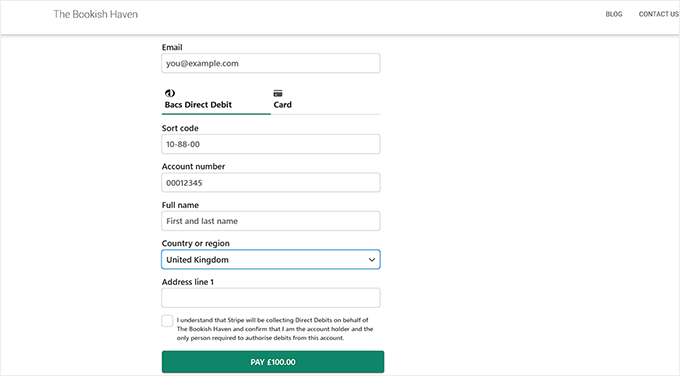

Technique 2: Settle for Bacs Funds in WooCommerce With Guide Financial institution Transfers

Should you already run a WooCommerce retailer and wish to attain UK clients with out further plugins, then this technique works effectively.

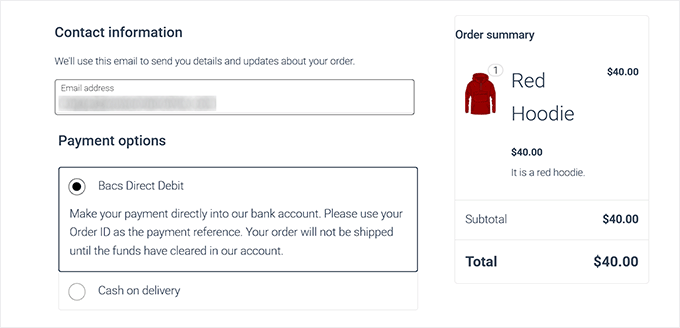

WooCommerce comes with a built-in Direct Financial institution Switch choice, which works completely for dealing with Bacs funds. Clients merely select this selection at checkout, ship cash on to your checking account, and also you affirm the cost in your finish.

Nevertheless, earlier than I dive into the setup, it’s vital to grasp the trade-offs of this strategy:

No automation: You must verify your checking account and manually mark every order as paid.

Slower course of for purchasers: Clients should go away your website to finish the cost by means of their on-line banking.

Finest for low quantity: This works effectively if you happen to solely course of a couple of orders per 30 days, however it isn’t excellent for busy shops.

For small or native companies, this setup is a straightforward, no-fuss approach to settle for Bacs funds with out further prices.

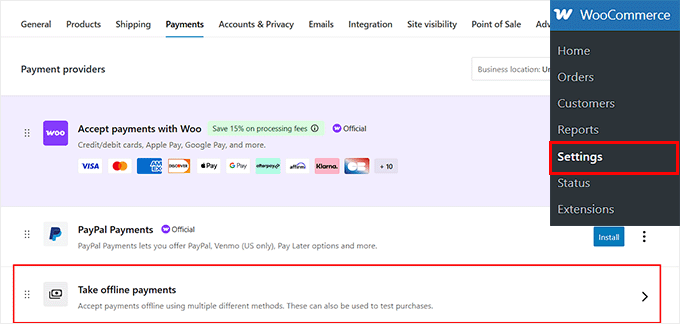

Step 1: Allow Bacs Direct Debit

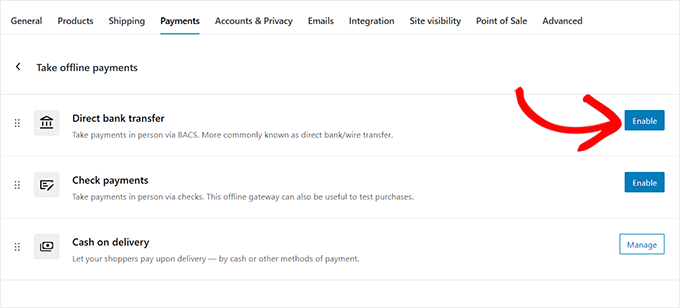

First, head over to your WordPress dashboard and go to WooCommerce » Settings » Funds. On this web page, you’ll see a listing of obtainable gateways.

Go forward and click on on the ‘Take offline funds’ choice.

It will convey up a display screen the place WooCommerce lists all of the offline cost strategies it helps, like Direct Financial institution Switch, Examine Funds, and Money on Supply.

Right here, merely click on the ‘Allow’ button subsequent to the ‘Direct Financial institution Switch’ choice.

Step 2: Configure Bacs Direct Debit Fee Settings

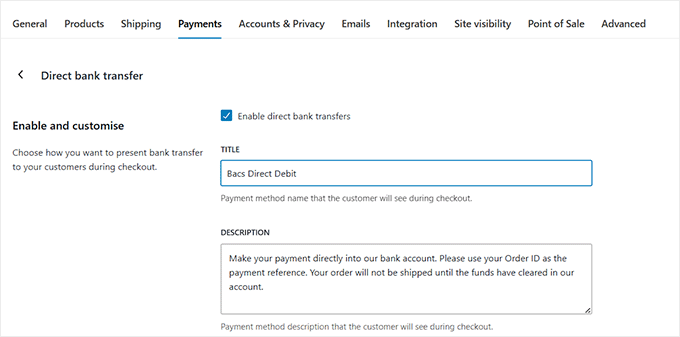

Now, click on the ‘Handle’ button subsequent to the Direct financial institution switch choice to regulate the settings.

You’ll now be directed to a brand new web page the place you’ll be able to change the title and outline that seem at checkout.

By default, it says ‘Direct Financial institution Switch,’ however you’ll be able to edit this to ‘Bacs Direct Debit’ or one thing clearer on your UK clients.

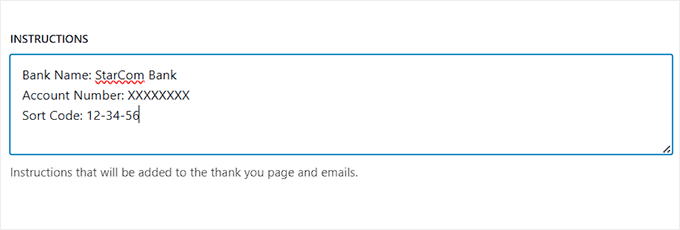

Scroll down a bit, and also you’ll discover the ‘Directions’ field. That is the textual content WooCommerce will present clients after they place an order.

Right here, I counsel including easy instructions like your financial institution title, account quantity, and type code so clients know the place to ship their cost.

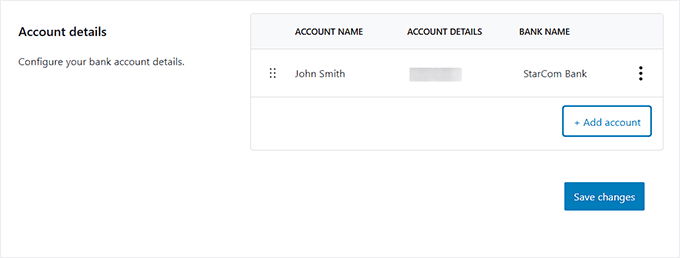

Lastly, below ‘Account Particulars’, it’s a must to enter the precise financial institution data that WooCommerce will show on the thank-you web page and order emails.

Should you work with a number of financial institution accounts, you’ll be able to even add multiple right here.

When the whole lot appears good, don’t overlook to click on ‘Save Adjustments’ on the backside to retailer your settings.

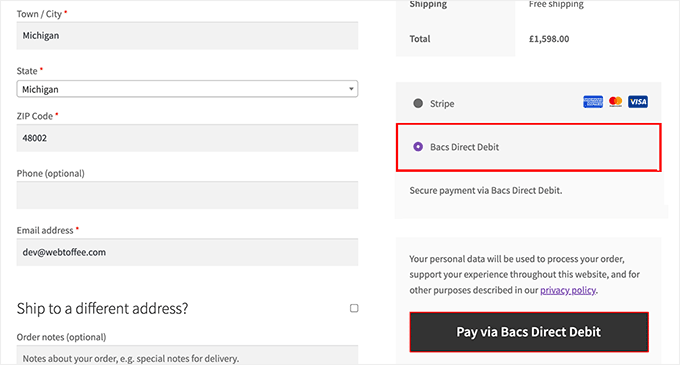

Now, you’ll be able to go to your on-line retailer to see the Bacs Direct Debit cost choice in motion.

Technique 3: Settle for Bacs Direct Debit Funds in WooCommerce With a Plugin (For Automated Funds)

If the handbook course of in Technique 2 appears too time-consuming on your WooCommerce retailer, then this automated answer is the proper different.

In contrast to handbook financial institution transfers, Stripe handles the whole lot within the background. From approving the mandate to gathering funds, you don’t need to verify funds individually.

Step 1: Set Up the Fee Gateway Plugin

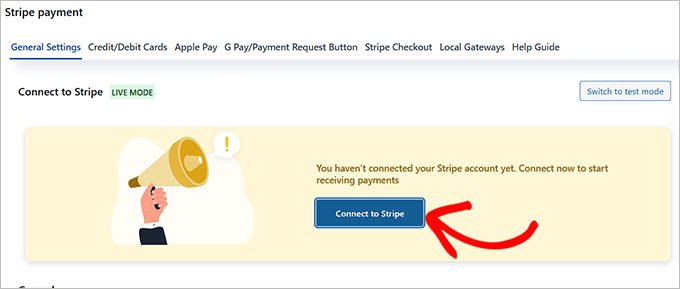

For this, that you must set up and activate the free Fee Gateway for Stripe and for WooCommerce plugin.

Should you don’t understand how to do this, you’ll be able to observe our information on putting in a WordPress plugin.

Upon activation, it’s a must to join the plugin with Stripe. To try this, go to the WebToffee Stripe web page in your WordPress dashboard and click on the ‘Connect with Stripe’ button.

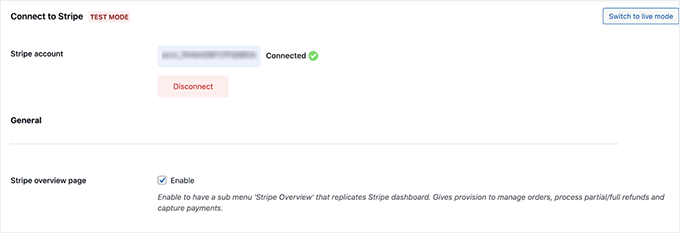

It will open a window, the place you’ll be able to log in to your current Stripe account or create a brand new one. When the connection is full, you’ll see a affirmation display screen displaying your retailer is linked.

By default, Stripe begins in take a look at mode, however you’ll be able to swap to stay mode anytime from the highest proper nook.

Step 2: Activate Bacs Direct Debit Funds

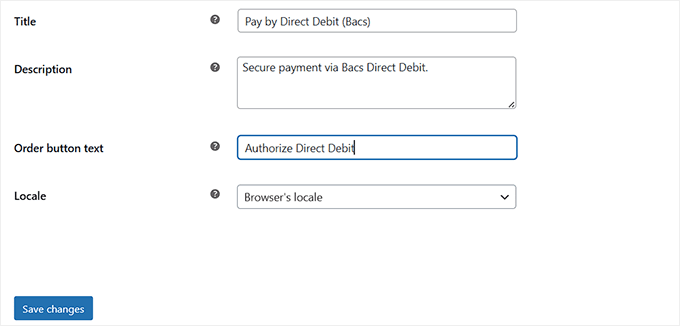

Subsequent, swap to the ‘Native Gateways’ web page and choose the ‘Bacs’ choice.

Then, verify the ‘Allow’ field so as to add Bacs as a cost technique in your retailer.

It’s also possible to edit the title, description, and button textual content at checkout. This makes the method clear and easy for UK clients.

For instance, you would possibly change the title to ‘Pay by Direct Debit (Bacs)’. It’s also possible to use the outline to clarify that the cost can be collected by means of their financial institution as soon as they approve the mandate (the shopper’s permission so that you can accumulate funds).

Adjusting the button textual content to one thing easy like ‘Authorize Direct Debit’ may also make the method really feel extra reliable and clear.

📌 Vital Word: Make certain your retailer forex is about to GBP (£). Bacs solely works with kilos, so this step is crucial.

As soon as you might be finished, don’t overlook to click on ‘Save modifications’ to retailer your settings.

Now you can go to your WooCommerce retailer to see the automated Bacs direct debit cost choice.

🔐Safety Finest Practices for Accepting Bacs Direct Debit in WordPress

When you’ve arrange Bacs funds in your web site, the following step is ensuring the whole lot runs securely within the background.

Listed here are some vital steps you’ll wish to observe:

Set up an SSL Certificates: An SSL certificates ensures that buyer information (like financial institution particulars) is encrypted throughout checkout. Most internet hosting suppliers now supply free SSL, and it’s essential for any WordPress website that processes funds.

Use a Dependable Safety Plugin: A instrument like Sucuri or Cloudflare may also help you monitor threats, block suspicious site visitors, and scan for malware mechanically. To get began, check out our final WordPress safety information.

Allow Fee Logging: Each WP Easy Pay and WooCommerce allow you to log cost occasions. This provides you a report of failed or suspicious cost makes an attempt, which is admittedly useful for recognizing fraud early.

Maintain WordPress, Themes, and Plugins Up to date: Outdated software program is among the greatest safety dangers. It is advisable to usually replace your WordPress core, plugins, and themes to maintain your website safe.

Restrict Admin Entry: Should you’re not the one individual managing your retailer, then ensure that every staff member has the proper position. For instance, don’t give somebody full admin entry in the event that they solely have to handle orders. To get began, see our information on managing person roles and permissions.

Common Backups: Lastly, at all times have a backup plan. I arrange automated day by day backups with Duplicator in order that if one thing goes mistaken, I can simply restore my website. To do the identical, check out our tutorial on again up your WordPress website.

By taking these precautions, you’ll ensure that your Bacs Direct Debit setup isn’t simply working — it’s additionally safe and reliable on your clients.

Troubleshooting Widespread Points with Bacs Direct Debit Funds

Even with the whole lot arrange accurately, there could also be occasions when Bacs funds don’t undergo as anticipated.

When my pal first launched his subscription field with Bacs Direct Debit, we additionally bumped into a couple of hiccups — however with the proper troubleshooting steps, they had been simple to repair.

Listed here are a number of the commonest points and how one can deal with them:

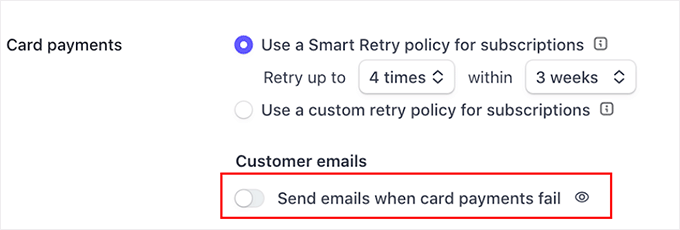

Set Up Correct Error Notifications

By default, Stripe logs each failed cost try. However you’ll wish to go into your Stripe dashboard and allow e-mail notifications for each you and your clients.

This fashion, clients immediately see why their cost didn’t undergo, and also you’ll additionally get an alert so you’ll be able to observe up rapidly.

With out this step, it’s simple to overlook failed funds till a lot later.

Fee Failures or Declined Transactions

Typically a cost fails as a result of the shopper’s financial institution doesn’t approve the mandate, or as a result of the account particulars had been entered incorrectly.

In these instances, you need to advise your clients to double-check their data or contact their financial institution.

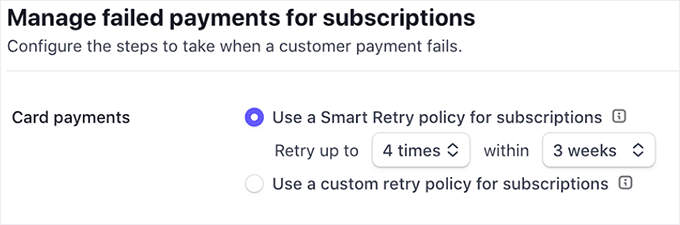

Managing Failed Fee Restoration

Contained in the Stripe dashboard, you’ll be able to arrange automated retries for failed funds.

That is particularly helpful for subscriptions, as a result of a single failed cost doesn’t imply you’ve misplaced the shopper.

Stripe can try the cost once more after a couple of days, and you can even ship a reminder e-mail with a hyperlink to replace cost particulars.

Contacting Fee Supplier Assist

Should you’ve tried the fundamentals and the problem nonetheless isn’t resolved, then don’t hesitate to achieve out to your cost supplier.

Stripe gives detailed error logs and stay help, which might turn out to be useful once you aren’t certain if the problem is out of your finish or the shopper’s financial institution.

🔑The important thing takeaway? Most Bacs points aren’t everlasting roadblocks — they simply want clear communication along with your clients and a fast verify inside your Stripe or WooCommerce dashboard. With the proper notifications and follow-up, you’ll be able to hold issues working easily with out dropping gross sales.

Different Fee Choices to Think about (Moreover Bacs)

Whereas Bacs Direct Debit is nice for UK clients preferring financial institution funds, it’s not the one choice you need to have in your checkout web page.

Actually, providing a number of cost strategies offers clients extra flexibility and might scale back cart abandonment.

Listed here are a couple of options chances are you’ll wish to add alongside Bacs:

💳 Card Funds (Stripe/PayPal): The quickest and commonest choice worldwide. Most UK consumers use debit or bank cards, so enabling Stripe or PayPal card funds ensures your checkout feels acquainted and handy.

⚡ Quicker Funds (UK): That is one other financial institution switch technique. However in contrast to Bacs, it clears inside minutes as a substitute of some days. Nice for one-off or pressing funds.

💰 PayPal Recurring: For subscription-based providers, PayPal recurring funds are a trusted selection. Many shoppers have already got PayPal accounts, in order that they really feel extra snug subscribing with it.

🏦 ACH (US Clients): ACH is mainly the American model of Bacs. Should you additionally promote to US clients, it’s price enabling. Like Bacs, funds take a couple of days to clear however are cheaper than card transactions.

🌍 SEPA Direct Debit (EU Clients): SEPA is the European equal of Bacs. In case your WooCommerce retailer attracts consumers from the EU, enabling SEPA offers them a well-recognized and native cost choice.

For extra choices, you’ll be able to see our full information to accepting funds in WordPress.

Ceaselessly Requested Questions About Bacs Direct Debit Funds

Listed here are some questions that our readers incessantly ask about Bacs direct debit funds:

Do I would like a developer to arrange Bacs Direct Debit in WordPress?

No, you don’t want a developer. Plugins like WP Easy Pay and WooCommerce make the method easy. So long as you’re snug putting in and configuring plugins, you’ll be capable to deal with the setup by yourself.

How a lot does it price to simply accept Bacs Direct Debit?

Bacs is normally cheaper than card funds. Should you’re utilizing Stripe, the price is about 1% per transaction + 20p, capped at £2. This makes it probably the most reasonably priced cost strategies for UK companies, particularly if you happen to course of bigger transactions.

Is Bacs Direct Debit protected for my clients?

Sure. Bacs funds are protected by the Direct Debit Assure, which suggests clients are lined in opposition to any errors or unauthorized funds. Plus, Stripe and WooCommerce deal with the technical safety, and with SSL enabled in your website, delicate information stays encrypted.

Do I would like a Service Consumer Quantity (SUN) for Bacs Direct Debit funds?

Should you’re a small enterprise utilizing Stripe with WP Easy Pay or WooCommerce, you don’t want to use for a SUN straight. Stripe works with a Bacs-approved bureau, which supplies the SUN in your behalf.

Nevertheless, if you happen to needed to gather Direct Debit funds straight by means of your financial institution with out a supplier like Stripe, then sure, you would want to use on your personal SUN. Take into account that this is usually a prolonged and tough course of for brand new or smaller companies.

I hope this text helped you discover ways to simply settle for Bacs direct debit funds in WordPress. You may additionally wish to see our information on settle for deposit funds in WordPress and our comparability of Stripe vs. PayPal to search out out which is healthier on your on-line retailer.

Should you preferred this text, then please subscribe to our YouTube Channel for WordPress video tutorials. It’s also possible to discover us on Twitter and Fb.